Tolls for other categories of vehicles are collected under the so-called “closed” system. A ticket is collected at entry gates while starting the journey and payment is made at the end of the journey, at the exit gates. The toll amount is calculated as the function of the vehicle category and the distance driven.

Toll stations (SPOs), except for the main toll plazas (PPOs) in the main corridor, are located on the entry and exit roads (the so-called slip roads) of the motorway junctions. There are twelve toll collection sites along the Motorway in total: PPO Rusocin, SPO Stanisławie, SPO Swarożyn, SPO Pelplin, SPO Kopytkowo, SPO Warlubie, SPO Nowe Marzy, SPO Grudziądz, SPO Lisewo, SPO Turzno, SPO Lubicz, and PPO Nowa Wieś.

Upon entering the motorway, you collect a single-ride ticket entitling you to drive any fragment of the road between Rusocin and Nowa Wieś. You must keep the ticket, as it will be used to charge the toll.

Having no valid entrance ticket to present you will be charged the maximum rate set in the valid tariff for the specific vehicle category and the specific tolling site.

Toll rates

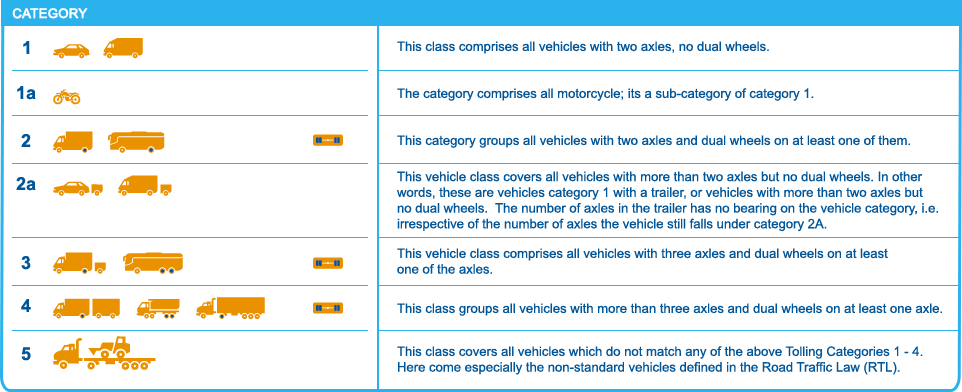

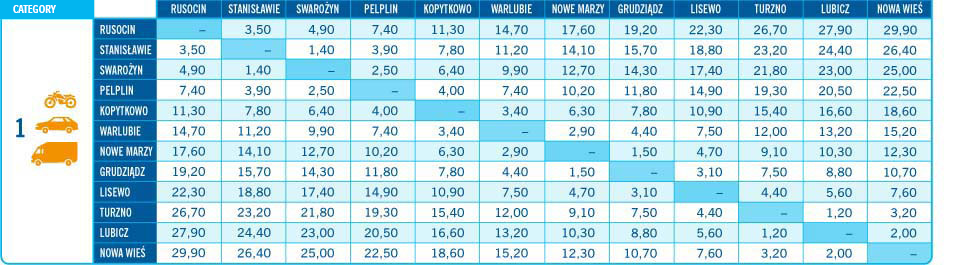

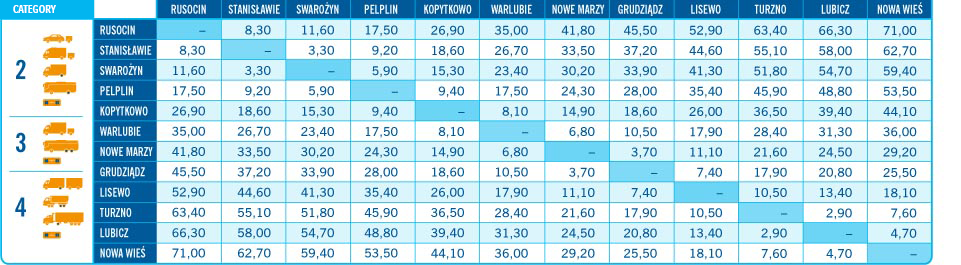

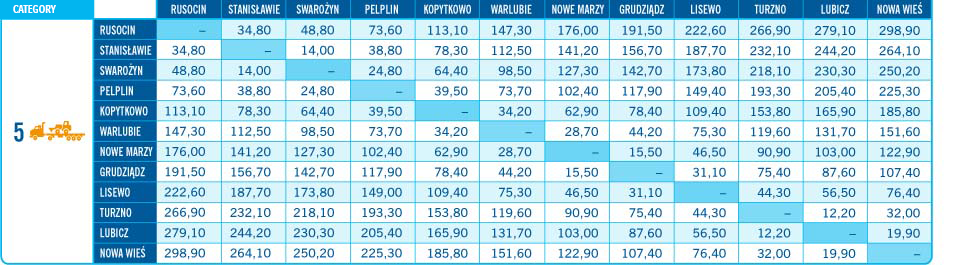

The toll rates, set by the Minister of Infrastructure per kilometer, net of VAT, are presented in the table below:

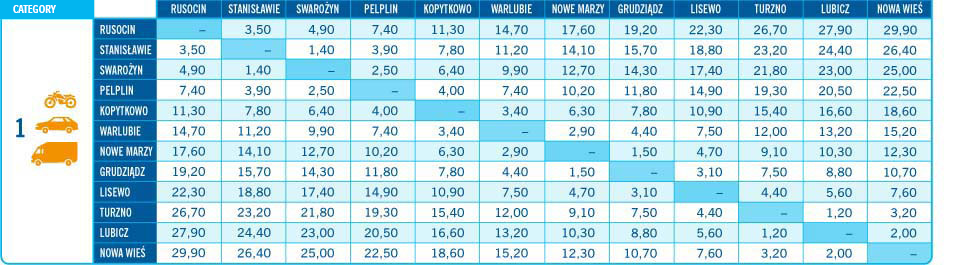

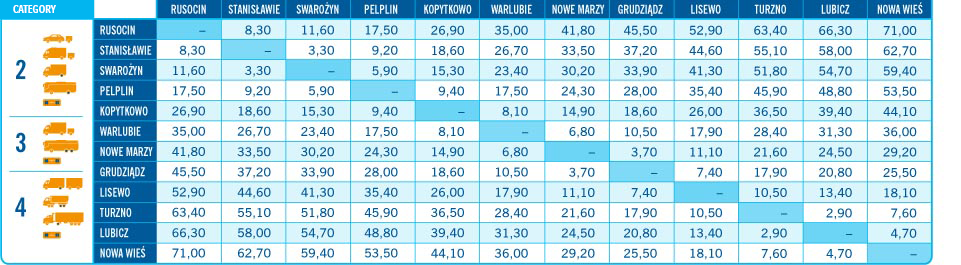

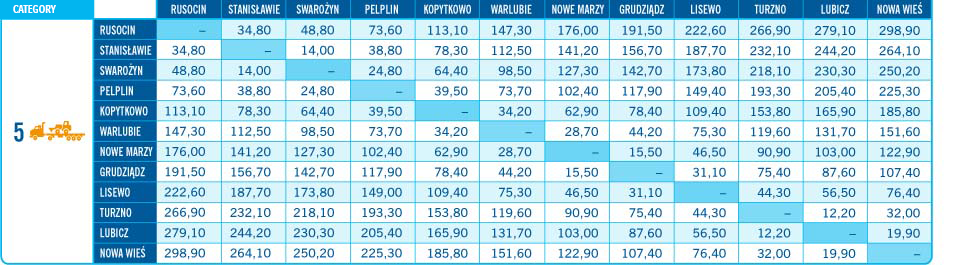

The rates, VAT inclusive (valid as of 11 February 2012)

CATEGORY 1*

*According to the instructions received from the Ministry of Infrastructure, from 4 September 2023 from 12:00 to 31 December 2023 at 23:59, all vehicles of categories 1 and 1A are exempt from tolls for the A1 AmberOne Motorway.

CATEGORY 2-4

CATEGORY 5

Payment methods

We accept payment in cash, credit cards, fuel cards and electronic payments in AmberGO system.

VAT invoice

The Company does not issue VAT invoices for the paid A1 Motorway toll.

The regulations of the Goods and Services Tax Act and the secondary legislation thereto [i.e. Regulation of the Minister of Finance, dated 3 December 2013, on the issuance of invoices (Journal of Laws from 2013 it. 1485)] list the compulsory elements of a VAT invoice. Pursuant to the regulations, the receipt confirming the effected payment for using a toll motorway (cash register receipt) is a VAT invoice as construed in the VAT tax law. The invoice number is the unique print number located at the top of the receipt next to the date of issue.

The receipt further constitutes a document evidencing performance of a service, as referred to in Article 87 of the Tax Law Act, and satisfies the prerequisite feature of such document, i.e. it confirms the performance of the service consisting in making the motorway available for use.

Receipts

Pursuant to the applicable regulations (§ 3.4.a-f of the Regulation of the Minister of Finance on issuing invoices, dated 3 December 2013, Journal of Law 2013, item 1485), cash register receipts enable fiscal recognition of the toll paid for the use of the A1 motorway as a tax-deductible and VAT tax input credit item.

Please, also note that the company does not issue duplicate cash register receipts, nor can it print copies thereof from the register.

A duplicate of a cash register receipt is not the same as a copy of a cash register. A duplicate is a counterpart of a document, identical with the original (generated from the same source). This, combined with no technical possibility and the applicable tax regulations prevents generation of duplicates from cash registers.

Missing ticket

The ticket is the document entitling the holder to a single ride on the A1 motorway along any selected fragment of the Rusocin-Toruń section. It remains valid for 48 hours after issue. The ticket should be kept for control at the toll gate. Having no valid ticket a driver is obliged to pay the maximum rate envisaged in the valid toll rate table.

The above does not apply to users of our electronic toll collection AmberGO.

Exempt vehicles

This is to advise that pursuant to section 5 of the Act of 29 August 2014 on Amendments to the Act on Public Roads, Act on toll motorways and the National Road Fund, and the Act on road transport (Journal of Law of 1 October 2014, item 1310), the agreements on construction and operation, or operation only of motorways which were concluded before the effective date of the Act of Law are subject to the previous regulations. The agreement with GTC S.A. was signed before the date the above-indicated Act of Law came into force and effect, hence it does not alter the catalogue of the vehicles exempt from the toll defined in the above agreement.